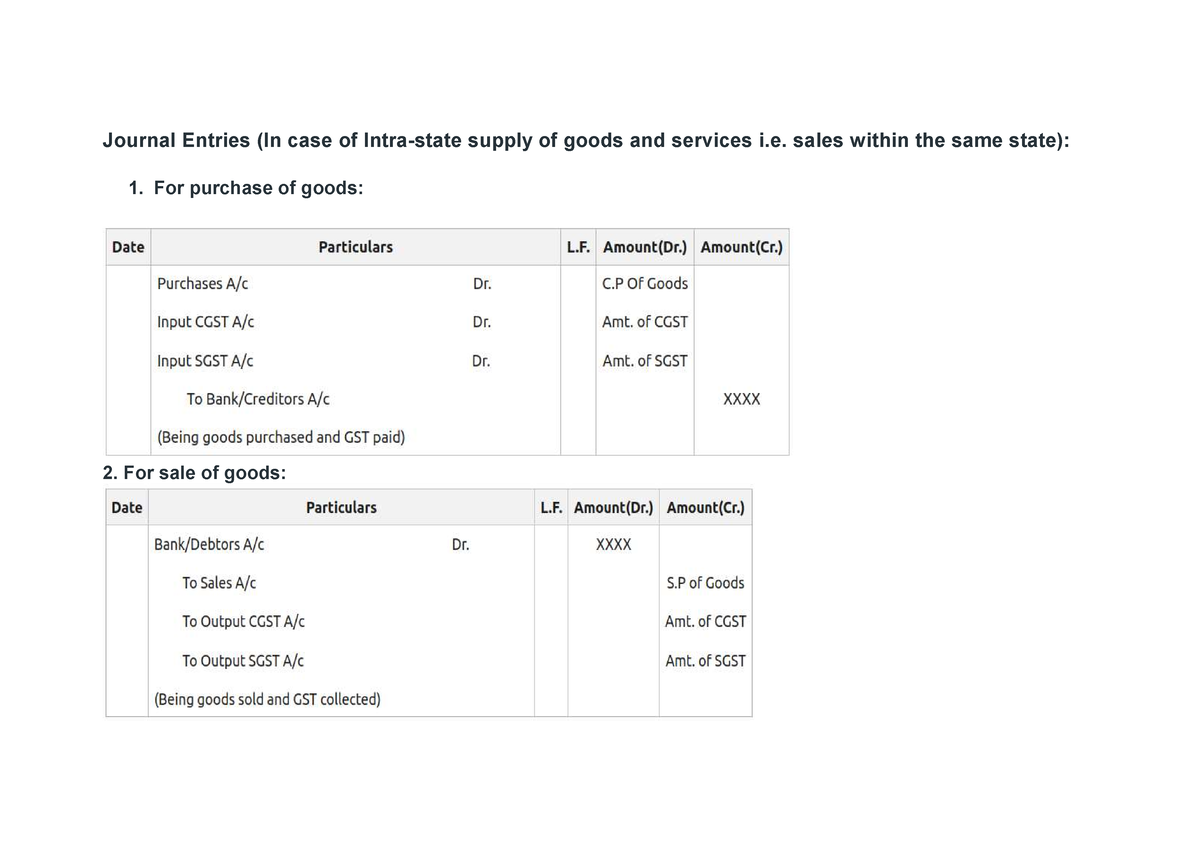

Journal Entries With Gst Questions And Answers . pass journal entries for the following transactions in the books of sahil ltd. Prerequisites for maintaining records and accounts under gst accounting. Simple guides for sales, purchases & payments. Section 35 of the gst act explains the. journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. master gst journal entries: Journal entries in gst would be kept separately for purchase transactions,. get a free trial. Assuming all transactions have taken place within the state of uttar pradesh. Assuming that both parties belong to. Conquer gst filing with clear explanations & downloadable examples! students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. pass entries in the books of mukerjee & sons. how do you pass a journal entry with gst?

from www.studocu.com

pass journal entries for the following transactions in the books of sahil ltd. Assuming all transactions have taken place within the state of uttar pradesh. Section 35 of the gst act explains the. Simple guides for sales, purchases & payments. Prerequisites for maintaining records and accounts under gst accounting. get a free trial. how do you pass a journal entry with gst? master gst journal entries: journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. Conquer gst filing with clear explanations & downloadable examples!

Journal Entries GST Summary Junqueira's Basic Histology Journal

Journal Entries With Gst Questions And Answers get a free trial. pass journal entries for the following transactions in the books of sahil ltd. get a free trial. journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. master gst journal entries: Section 35 of the gst act explains the. how do you pass a journal entry with gst? Prerequisites for maintaining records and accounts under gst accounting. Journal entries in gst would be kept separately for purchase transactions,. Assuming all transactions have taken place within the state of uttar pradesh. Assuming that both parties belong to. Simple guides for sales, purchases & payments. pass entries in the books of mukerjee & sons. Conquer gst filing with clear explanations & downloadable examples! students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10.

From www.teachmint.com

Tally Practice Set.jpg Tally Notes Teachmint Journal Entries With Gst Questions And Answers get a free trial. master gst journal entries: Assuming that both parties belong to. Simple guides for sales, purchases & payments. Conquer gst filing with clear explanations & downloadable examples! journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. Section 35 of the gst act explains the. Journal. Journal Entries With Gst Questions And Answers.

From www.meritnation.com

GST question pls journalise it 20 pass journal entries in the books of Journal Entries With Gst Questions And Answers master gst journal entries: Simple guides for sales, purchases & payments. how do you pass a journal entry with gst? Assuming that both parties belong to. journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. Prerequisites for maintaining records and accounts under gst accounting. Section 35 of the. Journal Entries With Gst Questions And Answers.

From www.carunway.com

Journal entries questions and answers CArunway Journal Entries With Gst Questions And Answers get a free trial. students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. Simple guides for sales, purchases & payments. Journal entries in gst would be. Journal Entries With Gst Questions And Answers.

From brainly.in

30 journal entries with Gst with ledger and trial balance for project Journal Entries With Gst Questions And Answers Conquer gst filing with clear explanations & downloadable examples! Prerequisites for maintaining records and accounts under gst accounting. get a free trial. master gst journal entries: journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. Simple guides for sales, purchases & payments. Section 35 of the gst act. Journal Entries With Gst Questions And Answers.

From www.youtube.com

GST basics and Journal Entries Simple GST Journal Entries Class Journal Entries With Gst Questions And Answers students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. pass journal entries for the following transactions in the books of sahil ltd. how do you pass a journal entry with gst? master gst journal entries: Conquer gst filing with clear explanations & downloadable. Journal Entries With Gst Questions And Answers.

From www.studypool.com

SOLUTION Tally GST Questions and Answers Studypool Journal Entries With Gst Questions And Answers how do you pass a journal entry with gst? students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. Section 35 of the gst act explains the. pass entries in the books of mukerjee & sons. Journal entries in gst would be kept separately for. Journal Entries With Gst Questions And Answers.

From www.youtube.com

GST Input Tax Credit ITC Accounting Journal Entries with EXAMPLES Journal Entries With Gst Questions And Answers Conquer gst filing with clear explanations & downloadable examples! Section 35 of the gst act explains the. how do you pass a journal entry with gst? master gst journal entries: Assuming that both parties belong to. pass journal entries for the following transactions in the books of sahil ltd. Prerequisites for maintaining records and accounts under gst. Journal Entries With Gst Questions And Answers.

From www.youtube.com

GST Journal entry class 11 Basic concept of GST Journal Entries Journal Entries With Gst Questions And Answers Simple guides for sales, purchases & payments. Section 35 of the gst act explains the. pass journal entries for the following transactions in the books of sahil ltd. journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. Prerequisites for maintaining records and accounts under gst accounting. Assuming that both. Journal Entries With Gst Questions And Answers.

From www.youtube.com

03 GST ITC Set Off Rules And Journal Entries GST Payment Journal Journal Entries With Gst Questions And Answers pass entries in the books of mukerjee & sons. Assuming that both parties belong to. how do you pass a journal entry with gst? get a free trial. Section 35 of the gst act explains the. Journal entries in gst would be kept separately for purchase transactions,. pass journal entries for the following transactions in the. Journal Entries With Gst Questions And Answers.

From www.scribd.com

Journal Entries and GST Accounts for Various Business Transactions of Journal Entries With Gst Questions And Answers Prerequisites for maintaining records and accounts under gst accounting. how do you pass a journal entry with gst? master gst journal entries: Journal entries in gst would be kept separately for purchase transactions,. pass journal entries for the following transactions in the books of sahil ltd. pass entries in the books of mukerjee & sons. . Journal Entries With Gst Questions And Answers.

From www.youtube.com

How To Pass Journal Entry in GST YouTube Journal Entries With Gst Questions And Answers Assuming all transactions have taken place within the state of uttar pradesh. Assuming that both parties belong to. students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. Prerequisites for maintaining records and accounts under gst accounting. journal entries for gst include several transactions, such as. Journal Entries With Gst Questions And Answers.

From www.youtube.com

GST basics & Journal Entries YouTube Journal Entries With Gst Questions And Answers Conquer gst filing with clear explanations & downloadable examples! students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. Simple guides for sales, purchases & payments. master gst journal entries: Assuming that both parties belong to. journal entries for gst include several transactions, such as. Journal Entries With Gst Questions And Answers.

From www.studocu.com

6 Journal Entries ques Questions for practice of tally step by step Journal Entries With Gst Questions And Answers pass journal entries for the following transactions in the books of sahil ltd. Prerequisites for maintaining records and accounts under gst accounting. master gst journal entries: Assuming that both parties belong to. students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. Simple guides for. Journal Entries With Gst Questions And Answers.

From www.youtube.com

Question_2_gst_in_journal_entry_accounts_class_11 s.c. sharma Journal Entries With Gst Questions And Answers Conquer gst filing with clear explanations & downloadable examples! students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. how do you pass a journal entry with gst? pass journal entries for the following transactions in the books of sahil ltd. journal entries for. Journal Entries With Gst Questions And Answers.

From www.youtube.com

2 accounting for GST। complete journal entries covered YouTube Journal Entries With Gst Questions And Answers journal entries for gst include several transactions, such as purchase transactions, sale transactions, reverse charge transactions, refunds, and. pass journal entries for the following transactions in the books of sahil ltd. Assuming all transactions have taken place within the state of uttar pradesh. Assuming that both parties belong to. master gst journal entries: Prerequisites for maintaining records. Journal Entries With Gst Questions And Answers.

From www.youtube.com

Steps to Pass Journal Entries with GST Journal With GST How to Pass Journal Entries With Gst Questions And Answers Assuming all transactions have taken place within the state of uttar pradesh. master gst journal entries: students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. Journal entries in gst would be kept separately for purchase transactions,. Assuming that both parties belong to. Section 35 of. Journal Entries With Gst Questions And Answers.

From www.youtube.com

GST Journal Entries Part 2 Purchase and Sale Journal Entries with GST Journal Entries With Gst Questions And Answers Journal entries in gst would be kept separately for purchase transactions,. master gst journal entries: students can refer below for solutions for all questions given in your dk goel accountancy textbook for class 11 in chapter 10. Simple guides for sales, purchases & payments. how do you pass a journal entry with gst? pass journal entries. Journal Entries With Gst Questions And Answers.

From www.teachoo.com

Entries for Sales and Purchase in GST Accounting Entries in GST Journal Entries With Gst Questions And Answers how do you pass a journal entry with gst? Assuming all transactions have taken place within the state of uttar pradesh. Conquer gst filing with clear explanations & downloadable examples! pass journal entries for the following transactions in the books of sahil ltd. master gst journal entries: Simple guides for sales, purchases & payments. pass entries. Journal Entries With Gst Questions And Answers.